|

|

|

The investment strategy we implement for you will be designed around your objectives, resources, and risk tolerance. We offer a wide range of strategies ranging from pure income generation to aggressive growth with tax-efficient sectors. ![]()

|

||||||||||

|

|

|

|

|

|

|

||||

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

| Aggressive Growth & Income Strategy | ||

|---|---|---|

|

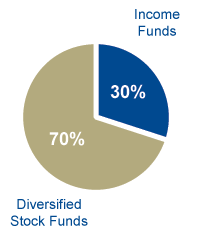

The Aggressive Growth & Income Strategy seeks long-term growth by investing in diversified stock funds and

bond funds, with a target mix of 70% stock, and 30% bond. Typically it will hold 2-3 domestic stock

funds, representing about 300-400 unique stock positions, and 2-3 bond funds, representing over 1,000 bond issues.

Foreign exposure usually ranges between 5-20%. Diversified stock funds are normally picked from Fidelity’s

retail lineup, but we may opt to hold a non-Fidelity fund if a particular stylebox is not well-served under the Fidelity

umbrella. The portfolio attempts to outperform the S&P 500 while maintaining a risk level that is similar or lower.

During bearish market conditions the portfolio may increase its weighting in bond funds, but such defensive measures are not expected to be routine. We believe a stable allocation generates a higher long-term return than trying to boost stock exposure during bullish periods, or reduce it during a bear market.

|

|

| Number of Funds Held: | 3 - 6 | |

| Relative Volatility: | 0.60 - 1.00 | |

Bowers Wealth Management, Inc. is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Bowers Wealth Management, Inc. and its representatives are properly licensed. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Bowers Wealth Management, Inc., unless a client service agreement is in place.

| CRS | Legal Information | Privacy Policy |