Asteroid Threat: Will Gold Become a Sitting Dinosaur?

In theory this should be a great time to own gold. The Fed has massively expanded its balance sheet for the second time in eleven years. U.S. federal debt is now up to 100% of GDP and should top out near 110%. The money that has been "printed" has sown the seeds of inflation, which might start showing up in the CPI numbers in 2-3 years, and the Fed has just announced that they won’t be doing anything right away if that happens. No wonder some investors are asking, "how can I go wrong hedging my portfolio with a gold ETF?"

Well, for starters, this is not 1980. We’re now in an age of technology disruption, where scarcity is being replaced by abundance. Technology’s deflationary pressures occur not only because of supply chain efficiency and increased automation, but also because it creates new ways of doing things, resulting in potent competition that drives down prices. Over the last decade, inflation in the developed world might have ended up at least one percentage point higher if technology had not enabled shale drilling (creating an abundance of oil and gas), allowed the substitution of nickel pig-iron for high-grade nickel (creating an abundance of steel), or unlocked the potential of genetic modification (creating an abundance of food commodities).

Lower inflation means low interest rates on government debt. Japan’s debt-to-GDP ratio currently stands at about 240%. That would have been unsustainable in 1980, when Japanese interest rates averaged 8% following a wave of oil-price inflation from the 1970s. But today, thanks to near-zero interest rates on government bonds and the added tax revenue from a 10% national sales tax, Japan has avoided any major struggles in servicing its debt so far.

Here at home, our U.S. federal debt burden is only about 40% as great, and with a population and economy that are growing faster than Japan’s, we’re not yet at a point where we need additional taxes to service it – though that day may not be far off. On the plus side, each additional dollar on the Fed’s balance sheet creates a dollar of added value in the private sector, which is one reason why the stock market has responded favorably. The Federal government is effectively making an investment in the economy by preventing avoidable bankruptcies, which in turn protects future tax revenue (which stands to grow faster than inflation).

Clearly, the Fed has learned from its big mistakes of the past. An inability to act as real interest rates rose above 10% in 1927, when agricultural commodities were collapsing due to the global adoption of the internal combustion engine, was the real reason for the 1929 stock market plunge and the Great Depression. All of it was avoidable, had it not taken until 1933 to abandon the gold standard and allow real interest rates to fall to an appropriate level. Fortunately, today’s Fed members were schooled in that debacle, which is why action (instead of inaction) has defined today’s response.

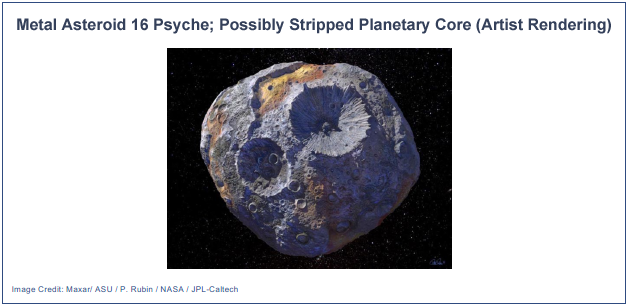

Of course, not everyone agrees that the current monetary stimulus measures are appropriate, and many who don’t have been buying gold and gold ETFs on the assumption that gold will hold its value better than the world’s major currencies. Not all of these gold bulls are aware that technology disruption now looms for gold, a metal that is relatively abundant in the universe but scarce on the surface of Earth. A large metal asteroid (16 Psyche), known to consist of nearly solid nickel and iron, and believed to contain a gold core, will be visited by a lander carried by SpaceX’s Falcon Heavy, the same rocket that put Elon Musk’s Tesla Roadster in orbit. NASA awarded SpaceX a $117 million contract in February; the scheduled launch is July 2022, with 2026 arrival. The mission is scientific in nature but could confirm that gold’s precious metal status is on borrowed time. Granted, outer space mining activity is likely 30-50 years in the future. But lacking any major industrial demand, gold’s price is not entirely driven by supply/demand factors. Some of it is due to the perception of scarcity, and sooner or later that perception could be altered (if not by robotic space-mining then perhaps by low-cost nuclear transmutation).

Even without disruptive technology, it’s important to realize that gold is a hedge, not an investment. It has not climbed much faster than inflation over the past 95 years. Stocks, in contrast, have outperformed inflation by seven percentage points annually over the same period, and there is little evidence to suggest that this rate of growth will be reduced by a higher level of U.S. federal debt.

Those who time the market while substituting gold for cash often operate under the illusion that they are protecting their lifetime savings. The reality is that they have greatly increased portfolio risk while eliminating any potential to build wealth in real terms over the long run. And because gold often moves lower at the same time that stocks move higher, coming to grips with the situation could involve a relatively painful financial lesson.

Third Quarter Review

The third quarter brought a faster-than-expected economic recovery as the number of new coronavirus cases topped out in July and then declined in August. While growth stocks continued to post unusually strong gains, a V-shaped rebound in consumer spending, construction, housing and industrial production provided a significant lift to beaten-down value stocks. While Congress could not agree on an extension to stimulus programs, the Fed took additional action on the monetary side which helped the economy to hold its own in September. Investors were encouraged by good news on the vaccine front, with several promising candidates entering stage three trials, and hospitals gearing up for an end-of-year rollout that could offer protection for front-line medical workers and other high-risk personnel. The S&P 500 finished the third quarter with an 8.9% gain, for a year-to-date gain of 5.6%.

The bond markets held up well in the face of stepped-up Treasury issuance, though government bond funds finished around breakeven for the three-month period. It was a better story for corporate bonds, with lower-grade issues benefiting most from the combined effect of strong demand from the Fed along with an improving economy. The Barclay’s U.S. Aggregate Bond Index returned 0.6% for the third quarter, finishing with a year-to-date increase of 6.8%. Our stock portfolios continued to outperform thanks to our overweighted large-cap growth positions. But as the valuation disparity between growth stocks and value stocks approached Y2K-like extremes, we opted to take some profits and boost our exposure to value funds. In most cases these moves had a neutral-to-positive impact on performance. Bond-wise our exposure to corporates allowed conservative accounts to finish ahead of the Barclay’s index for the quarter, whereas accounts with high-yield bond exposure ended substantially ahead of the benchmark.

Outlook

Some investors remain nervous about the upcoming November election, but the market’s reaction could be muted this time around (regardless of the outcome). The future of corporate earnings is not so much in the hands of politicians these days; what matters far more is progress on the vaccine front and getting the economy back to full strength. Markets tend to rally on the removal of uncertainty, and right now the uncertainty posed by the pandemic is much greater than any uncertainty surrounding the election or future tax policy. As such, we continue to make adjustments to keep our portfolios aligned with their risk targets, but we’re not seeing any need to adopt a defensive posture.

As for the economy, we expect somewhat of a holding pattern during the final quarter of the year, but there are good reasons to be optimistic for 2021. A global vaccine rollout holds the promise of herd immunity and a rebound in travel and leisure activities. Here at home, a follow-up stimulus package remains likely, but even if it doesn’t happen, robust housing sales, continued construction, and a rebound in industrial production may be enough to keep the job market growing.

While growth stocks are fully valued, there are many opportunities on the value side. And because managers tend to do well at identifying winners and losers in this kind of situation, we think it makes sense to continue favoring active funds for our value-oriented positions. Our overall portfolio stance still has a slight bias toward growth stocks, but as the economy hits its stride we will be looking to move more toward the value side.

Sincerely,

Jack Bowers

President & Chief Investment Officer