Technology is Easing the Path to Clean Energy

It’s not an easy exercise trying to figure out how the global economy could run with near zero dependence on fossil fuels. A decade ago, such a scenario would have easily been dismissed as impossible, or at the very least impractical until 2050 or later. But plunging costs for photovoltaic solar, wind power and battery storage have allowed the U.S. power grid to become 40% carbon-free sooner than expected. Plus, there is more interest in the electrification of transportation. Perhaps smog-free skies in Los Angeles, Beijing and New Delhi in April of 2020 provided the inspiration. Or maybe the sky-high energy prices that followed Russia’s invasion of Ukraine. Regardless, sales of new battery-electric vehicles are now up to about 20% in China, 10% in Europe, and 6% here at home.

The global economy is clearly on an accelerated push toward clean energy - an uncharted path that has evoked concerns about power grid stability, reduced fossil-fuel investment (which could lead to higher fuel prices), and shortages of key battery materials (such as lithium, nickel and cobalt).

But increasingly, it appears that the global economy will dodge those bullets. The slow pace of the transition makes it easy to identify and resolve potential problems before they become major issues (we are likely talking about a transition period of roughly three decades). And fortunately, government regulators around the world have tended to avoid heavy-handed mandates, preferring incentives and market-oriented solutions instead. For example, even in places where new gasoline-car sales are being "banned" starting 2035, consumers who prefer internal combustion will still be able to buy plug-in hybrids, and drive them around without ever plugging them in (much as Toyota once advertised). In the EU, engines that run on synthetic E-fuels (clean-energy versions of diesel/gasoline made from renewable electricity, water, and carbon-dioxide) will be allowed indefinitely.

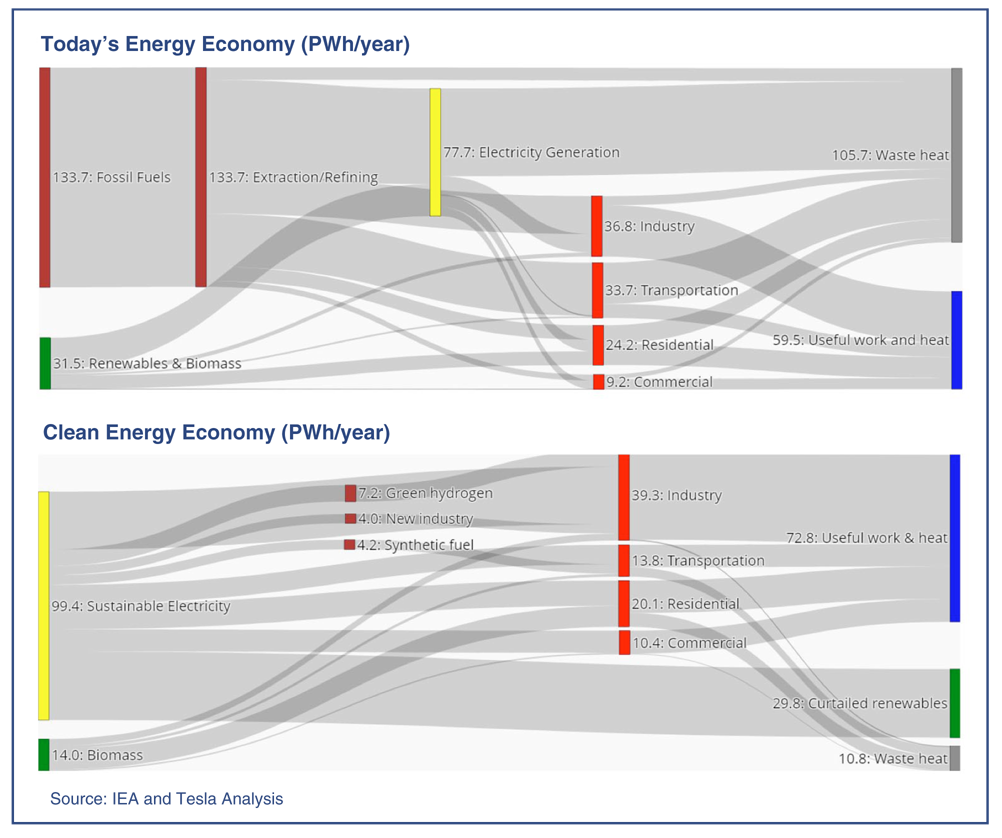

Advancing technology is what puts a clean energy economy within reach. Over the last decade, PV solar and wind turbines have become the lowest cost sources of power generation. The declining cost of LFP (Lithium Ferro-Phosphate) batteries has set the stage for a similar scale-up in battery storage, which allows grid power to be stored at night and delivered during the daytime, potentially doubling peak capacity while boosting grid stability. This could make it easier for utilities to phase out fossil fuel generation while simultaneously handling the increased demand from electric vehicles (if all vehicles go electric, it would boost grid demand by about 25%).

There are other breakthroughs on the horizon as well: fusion nuclear (which does not create any long-lived radioactive waste or require an elaborate cooling system) and deep geothermal (drilling far enough into the earth’s crust to reach 500-degree temperatures). Either one could make it possible to electrify heavy industrial processes and allow synthetic E-fuels to scale up cost-effectively.

Some firms are not waiting for new breakthroughs, preferring instead to launch into a clean energy approach with today’s technology. Boom Supersonic, which is developing a modern version of the Concorde jet (slated to begin service around 2030), plans to fuel its planes with carbon-neutral jet fuel from day one. The fuel won’t be cheap, but high ticket prices will cover it.

Separately, oil giant Occidental has broken ground in Texas on a project that will scrub carbon-dioxide out of the atmosphere using wind power, financing it in part by selling carbon credits. While dismissed by some as an image-boosting gimmick, it’s still a big plan, and capturing 30 million tons of carbon dioxide per year could allow them to sell carbon-neutral fuel if the economics work out.

There are some who argue that climbing aboard the clean energy train is a derailment waiting to happen, with the possibility of soaring energy costs that hammer the economy. Problem is, there’s a risk (beyond climate damage) in sticking with the status quo: U.S. shale oil production is peaking, and shale producers are running hard to stay even when it comes to maintaining output of oil and gas. Any significant decline in the return on investment for shale projects could portend the loss of U.S. energy independence for a second time.

Fortunately, with today’s energy technology it’s possible to electrify and eliminate fossil fuel dependence for all time. Plus, allocating capital to renewable power generation, battery storage, and electrification is unlikely to negatively impact the economy. These are things that improve overall efficiency and grid reliability, and the investment return is likely to remain attractive long term - with or without government incentives. As for battery material constraints, LFP cells do not use nickel or cobalt, and at this point the so-called lithium shortage has largely resolved thanks to stepped-up investment in battery-grade lithium refining (lithium is everywhere; the main issue is making it pure enough).

As for investment ramifications, the clean energy transition mainly impacts the energy (oil & gas), industrials, materials and utility groups. Expect lower returns for the oil & gas sector due to diminishing returns on exploration and development. Industrials could see more upside than downside as new factories are built and more mining equipment is sold. Materials should benefit from growth within the mining segment. Finally, electric utilities might benefit from increased power generation and a higher return on existing assets (thanks mainly to battery storage).

Second Quarter ReviewThe banking crisis continued to weigh modestly on the economy during the second quarter, with tighter credit conditions and declining inflation (4% year-over-year for May) prompting the Fed to pause its tightening campaign - as least temporarily - in June. But with monthly employment reports remaining stronger than expected throughout the period, the market continued to brace for another quarter-point tightening in July. While a recession cannot be ruled out, investors took heart that U.S. economic conditions are not that bad compared to other economies. In Europe and Canada, inflation was a bigger problem, prompting central banks there to step up the fight. China, on the other hand, had to reverse course due to a substantial economic slowdown; its central bank trimmed key lending rates.

Individual investors turned more bullish as the Federal debt ceiling standoff was resolved without any negative outcomes for the broad economy. Many looked to put cash to work in "recession-proof" themes such as Artificial Intelligence and clean energy, which reinforced the rebound in the major technology disruptor stocks while leaving most other market segments behind for the quarter. The NASDAQ, for example, finished with a 13.1% gain, versus the Russell 2000’s 5.2%. The S&P 500 split the difference, rising 8.7% for the quarter to finish with a 16.9% year-to-date gain. On the bond side, markets weighed off an improving inflation picture here at home versus one that is getting worse for some of our major trading partners. For the quarter, the Bloomberg Barclay’s U.S. Aggregate was down slightly, declining 0.8% to finish with a 2.1% year-to-date return.

Performance-wise, the sector side of our equity holdings outpaced the S&P 500, but our diversified fund holdings trailed due to our continued heavy emphasis on mid-cap stocks (which we reduced near the end of the quarter). On the bond side, most portfolios finished slightly ahead of the U.S. Aggregate’s return thanks to an emphasis on shorter-term debt, including exposure to the upper tiers of the high-yield segment in some accounts.

OutlookArtificial Intelligence (AI) has been playing a central role in this year’s market recovery. AI is considered the "next big thing" with potential to boost productivity and earnings on a broad scale, and is viewed by some as a “recession-proof” theme. Stock-wise, there are not many direct AI plays, because it is a massive technology challenge that is limited to those with deep pockets who can write high-quality software that is extremely fast (firms like Alphabet, Amazon, Apple, Meta, Microsoft, and Tesla). It has also favored firms who are in high-volume production with power-efficient processing chips capable of blazing speeds (such as Nvidia and Tesla). No surprise, these top seven stocks have accounted for the bulk of the S&P 500’s gain this year. While it’s not always a good thing when market breadth is narrow and expensive stocks become more expensive, the potential rewards of AI are big enough and broad enough that the presumed earnings boost could extend beyond these likely providers of AI technology. So far our Sector Model has been able to capitalize on the AI theme, thanks to overweighted bets on the communications services, consumer discretionary, and technology sectors. But to limit the risk of overweighting pricey sectors, we are also holding some defensive bets (health care and utilities) that may have a dilutive effect on recovery performance.

The other significant opportunity in this market is stocks with low valuations that have potential to recover as inflation continues to decline and the Fed reaches the end of its tightening cycle. These firms can be found mainly on the value side of the S&P 500, the growth side of the mid-cap arena, and across the board in the small-cap universe. Stocks in these segments have not seen much recovery this year because the banking crisis created new concerns, and the recession threat is not yet off the table. But that may change in the second half as the economic outlook brightens. We are in the process of repositioning our non-sector models so that they can benefit if small-caps and economically-sensitive value stocks stage a more earnest recovery; this may soon include a more direct bet on the Russell 2000.

On the income side, the downside risk from rising inflation has largely disappeared, but on the assumption that the Fed will take its time reversing course on interest rates, there may not be much recovery potential this year or next. Bond holdings still have potential to earn their yields, but not much more. Things look more optimistic over a three-year horizon as there may be greater potential for capital gains if inflation returns to 2% in 2025. We currently have modest bets on shorter-maturity bonds, both investment-grade and high-yield.

We may add to those positions as the yield curve shows signs of normalizing.

Sincerely,

Jack Bowers

President & Chief Investment Officer