Technology Disruption in the Transportation

Sector Could Run Broad and Deep

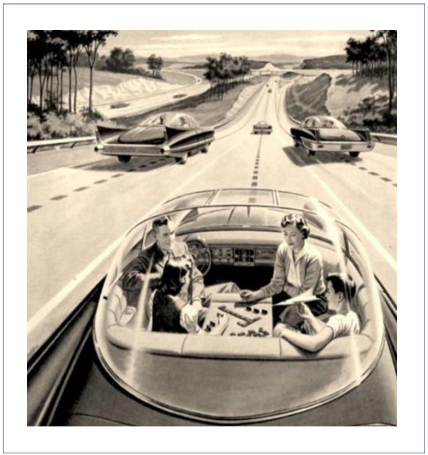

There’s a lot of discussion these days about robots and the threat they could pose to wage earners. But the "robots" that will have the earliest and biggest impact on today’s job market won’t even look like robots. You’ll see them in the parking lot, in the garage, and on the road. To the casual observer they will look much like the cars and trucks of today.

Self-driving vehicles, at first glance, may not seem like something that would shake up the job market in a big way. But in the U.S. there are some 5 million people who drive for a living, and over the next 10 years a significant percentage will end up doing something different. Many of them will continue working for the same employer in a different capacity. Some will help address the growing shortage of unskilled labor in other industries. A few will end up unemployed, but not enough to move the needle on the nation’s jobless rate.

Make no mistake, this is still a disruption. Some analysts think the cost of ground transportation could fall by a factor of 10, with productivity surging as commute time turns into work time. That’s enough to spark some significant trends: consumers giving up their cars for ride-sharing services, new delivery services for anything and everything, downward pressure on high-priced housing, a more robust economy driven by a surge in self-driving vehicle production and toll-road construction. There could also be downward pressure on domestic airfares and shipping rates, on vehicle insurance rates, on parking costs, and on prices for used vehicles lacking self-driving features (which may cause problems in the auto loan market and write-downs for leasing firms).

It may also mean lots of empty cars and lightly-loaded trucks will be on the road, creating additional congestion. Cars that are parking themselves. Cars that are dropping off their owners at the airport (or picking them up). Cars that are delivering food. Cars that are heading somewhere to charge themselves.

Trucks that are delivering parts for repairs that can’t wait for an overnight delivery service. Some of this activity may shift to nighttime hours, some of it may take to the skies via drones or short-range aircraft, and a surge in underground road construction could also help. It will also be nice to see self-driving trucks that are content to follow other trucks to save energy, as it will leave the left-hand freeway lanes open for cars.

Economic Implications

Economic Implications

First of all, we can probably rule out the possibility that self-driving vehicles will have a negative impact on economic growth. For every driving job that is lost, a new type of service job will likely be created.

Furthermore, the auto industry will be spending heavily throughout the period where drivers are being displaced. Even if there is not a full offset on the jobs front, the growing shortage of unskilled labor is only getting worse as the population ages, suggesting that some shippers and trucking firms will invest in self-driving vehicles not to cut costs, but to avoid losing revenue as they run short of drivers.

The economy should also benefit from increased discretionary spending. Consumers who save money by giving up their car for ride-sharing or delivery services will have extra income to spend someplace else. And the productivity gains that come from converting commute time to work time should translate to higher wages across all industries, which could further boost discretionary spending.

Finally, there could be a big benefit concerning vehicle accident and death rates, which currently inflict a huge financial toll on the economy. Self-driving vehicles may ultimately reduce crashes by a factor of 10, for annual savings equating to about 2.5% of GDP! That may put some insurance adjusters and body-shop technicians out of work, but consumers should benefit from lower insurance rates, leading to increased spending on other services.

All factors considered, it’s hard to see a scenario where self-driving vehicles would kill jobs and put the economy into a long-term slump.

Investment Implications

The transportation sector is currently riding a tailwind from declining fuel costs and the rising popularity of online shopping. But as driverless vehicle sales rise, and fleets and delivery services ramp up, the downward pressure on the cost of moving people and things is likely to weigh on the earnings of transportation firms while providing a tailwind for big transportation system users – mainly firms in the consumer, industrial, and materials groups.

The risks for the auto industry are more immediate. Heavy capital spending is required now for electric drivetrains and software development – both of which are necessary to compete in the self-driving arena. The software development side is particularly dicey, because it involves the creation of map databases and driving algorithms that make use of Artificial Intelligence (AI) software – an area where the auto industry has little prior experience. So far the industry has largely fumbled the ball on software, as evidenced by sub-standard navigation, media and driver assistance features. Third-party suppliers such as Mobileye, Waymo, and Apple may come to the rescue, but some loss of market share to Tesla is inevitable for the simple reason that it is moving faster in self-driving software development (Tesla is also creating more capacity than the rest of the industry combined in battery manufacturing and high-speed charging capability).

Overall the stock market should benefit significantly from the increased productivity that comes from being able to do more work while commuting or traveling. We saw something like this in the 1990s when cell phones suddenly made the business world more efficient. Self-driving vehicles could provide a boost significantly exceeding the productivity benefit of that period.

Second Quarter Review

French elections greatly reduced the risk of an EU breakup in the second quarter, prompting a rally in both European stocks as well as the euro. U.S. stocks, already benefiting from improved corporate earnings, tacked on additional gains as foreign revenue expectations crept up. Except in the energy patch, where U.S. shale producers have become so efficient and prolific that they appear able to boost oil production faster than OPEC members can reduce it. The recent decline in the price of crude was not as dramatic as 2014-2015, so it didn’t weigh much on the high-yield market. Still, energy stocks did come under pressure as long-term forecasts for the group were revised downward. Lower oil prices also brought expectations for lower GDP growth and inflation, so when the Fed stuck to its plan and boosted short-term rates another quarter point, some market participants were caught off-guard. As a result, long-term interest rates declined, and profit-taking activity picked up in some areas.

The prospect of a lighter regulatory touch gave a lift to stocks in the health care and financial sectors, as investors appeared largely unfazed by the media’s unrelenting focus on political drama, choosing instead to give Congress the benefit of the doubt on Obamacare repeal, corporate tax cuts, and the elimination of onerous banking regulations.

The S&P 500 rose 3.1% for the quarter. Our stock portfolios, which were helped by increased exposure to foreign stocks, finished ahead of the index. On the bond side, we performed on par with the Barclays U.S. Aggregate (which was up 1.5%).

Outlook

The Fed’s shift to a slightly more hawkish approach was driven in part by concern over "rich" valuations in some parts of the stock market, but the main concern was tightness in the labor market, which may have potential to boost wage inflation down the road.

Stocks remain fully valued, but earnings are on the upswing, and may get some additional help from both the weaker dollar and stronger economic growth overseas.

From a sector standpoint, these factors suggest that our portfolios may benefit from a shift in exposure from consumer-driven groups to industries that are more export-driven. This may include a return to the health care group, which is benefiting from a faster pace of FDA approvals. We also have our eye on the chemicals sector, which is benefiting from low-cost natural gas while spending heavily to boost U.S. exports of plastic. The chemicals segment also includes exposure to the agricultural seed segment, which is consolidating and winning a greater number of regulatory approvals for genetically modified products that boost farm yields while reducing the use of pesticides.

Sincerely,

Jack Bowers

President & Chief Investment Officer