Second Wind For Actively Managed Funds

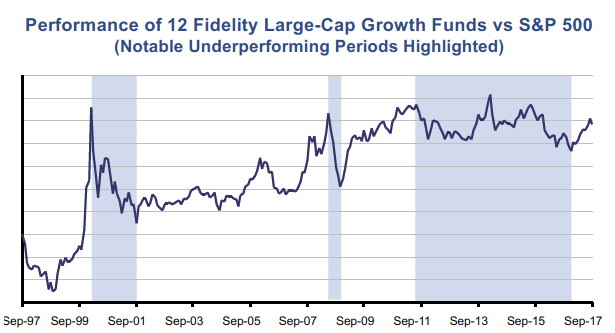

For more than five years, Fidelity’s large-cap growth funds trailed the S&P 500. Then beginning this year, stockpicking suddenly started to work again. The change in dynamics occurred in tandem with a significant reduction in active-fund outflows. And while it hasn’t spread beyond the large-cap growth segment at this stage, it offers a cautionary tale for anyone who thinks indexing can never lead to disappointing results.One of the immutable rules of market-based investing is that any approach that becomes too popular for its own good will run the risk of performing worse than expected. In other words, the market has a way of disappointing the majority. If a majority of investors want to buy something, prices rise until the number of buyers and sellers are exactly matched.

Strategies that have fallen victim to excessive popularity in recent decades include the January Effect, the Dogs of the Dow, Sell in May, market timing based on moving averages (or valuations / earnings yields), and sector rotation based on the economy’s position in the business cycle.

Indexing proponents may think that they are immune to excess popularity, because their approach does not involve seasonality, timing, or valuation-based techniques. But when stock markets are dominated by large amounts of capital flowing into capitalization-weighted indexes, it has the effect of propping up value stocks, holding back growth stocks, and inflating the value of stocks held in popular indexes (relative to comparable firms that are not part of those indexes). These distortions have a way of reversing once capital flows subside, allowing savvy managers to step further out on a limb without punishment. Most likely we’re at that point today.

The Risk of Lackluster Index Results Going Forward

Much like the 5-year period that followed the indexing craze of 1996-1998, today’s active managers may benefit from a heightened range of opportunities brought on by five years of risk-aversion and valuation conformity. Consider the following:

- There are fewer active managers still on the job, and those that remain are the cream of the crop. Today their funds are smaller and more nimble than they were five years ago.

- We are entering an age where technology disruption (driven by powerful AI software) may benefit a relatively small number of companies at the expense of the majority. It may not be an environment that rewards index strategies. Frequently, disruptor firms are not even admitted to popular indexes until they are fairly close to realizing their full potential.

- Some stocks now have more than 30% of their float held by passive investment vehicles, making them more volatile than stocks with lower levels of passive ownership. This means they can be gamed by active investors. Should passive ownership reach excessive levels, some stocks would be prone to flash-crash like behavior. If that point is ever reached, owners of popular indexes would likely defect to active funds in order to reduce their exposure to rising volatility.

- Many index investors are firmly convinced that a fund’s expense ratio is more important than anything else, when in fact it’s just one of many factors determining bottom-line performance. For this reason, if active funds reemerge as performance leaders, the trend is likely to be sustained for many years to come. Today’s passive investors may not budge for a decade or more, allowing active managers to remain nimble and focused even as assets grow.

Investment Implications

Stock indexing can still make sense where technology disruption is not a major factor, or when the index itself is heavily populated with disruptor firms. Ignored but important indexes may also enhance portfolio performance. But if today’s market continues to reward opportunistic behavior, the best bet for the large-cap growth segment is likely to be Fidelity’s actively managed funds, especially if their funds don’t add much volatility over a passive approach.

Active funds may also be the better bet for other asset classes not characterized by a large and consistent population of winners. This would include foreign stock funds, high yield funds, and investment-grade bond funds that aren’t focused on treasuries. Especially on the bond side, the risks that are mitigated by security selection can far outweigh the relatively modest expense ratios that Fidelity’s funds incur.

Finally, a word about passive ETFs. These investment vehicles have become popular because of their ability to be traded like stocks during market hours. However, that feature can come with hidden transaction costs (which are magnified when market liquidity is poor). For that reason, we favor index funds for our passive bets. Unlike ETFs they rarely trade below net asset value.

Third Quarter Review

Stocks moved higher during the third quarter, thanks to improved earnings that were helped by a weaker dollar and rising oil prices. At the same time, an increase in business spending and exports gave the economy added support.

The market’s relatively steady performance occurred against a backdrop of nail-biting news stories. A war of words between Trump and North Korea evoked memories of the Cuban Missile Crisis. The Fed made a hawkish shift and announced plans to begin unwinding its balance sheet holdings. Several powerful hurricanes tested the limits of disaster preparedness, relief efforts, and insurance company risk management. And the path to an extension on the Federal debt limit was anything but straightforward. The market’s muted response to these headline events was surprising to some, but refreshing to others. After nine years of worrying about things that had little impact on corporate earnings, the market is now worrying only about the things that do.

Our stock-oriented portfolios, which continued to emphasize technology, financial, and foreign stocks, finished slightly ahead of the S&P 500 for both the quarter and the year (during the third quarter the S&P 500 climbed 4.5%, and is up 14.2% year-to-date). The bond side of our portfolios did well too, outperforming the U.S. Bond Index (The Barclays U.S. Aggregate was up 0.8% for the quarter and returned 3.1% year-to-date.) We kept volatility similar to the Barclays by emphasizing high-yield and short-term debt, while going light on treasuries.

Outlook

The Fed appears to be setting its policy around expectations that tax reform efforts will succeed in delivering a boost to the economy while pushing inflation up closer to its 2% goal. Should Congress be unable to agree on a tax package, it would come as no surprise if the Fed puts its plan on hold. This policy stance also allows for a degree of flexibility during the unwinding of the Fed’s portfolio of mortgage securities and treasuries: depending on what happens to the yield curve, plans for the Federal Funds rate can be altered to mitigate any increased risk of recession or wage inflation.

While there have been many dramatic and sensational predictions for bonds coming out of the mass media, very little has changed for income-oriented investments on a fundamental basis. We believe today’s low inflation is largely the result of technology disruption, a global force that the Fed will ultimately have to acknowledge (and consider fully) in setting policy. Because interest rates are anchored to inflation, we don’t see bond pricing being swayed by Fed actions nearly as much as it has in the past. We remain satisfied with our current bond fund positions, and at this point we’re not looking to make changes.

Corporate earnings have been enjoying a tail wind thanks to this year’s decline in the dollar (which boosts the value of profits earned abroad and makes U.S. exports more competitive).While the dollar recently strengthened in response to the Fed’s plan (and due to increased political uncertainty in Europe), we think the Greenback has additional room to fall as interest rates continue to normalize in Europe and Japan.

Sincerely,

Jack Bowers

President & Chief Investment Officer