Bonds Still Play Important Risk-Reduction Role, and Are Likely a Better Bet Than Cash

As this year’s selloff goes, the decline on the stock side has been much like bear markets of the past. But the plunge on the bond side has been unusually painful. Bond losses don’t normally reach double-digit levels, and bonds don’t normally go down in tandem with stocks.

This unfortunate combination has taken a heavy toll on lower-risk portfolios. Conservative investors who follow those portfolios are now rightfully questioning the logic of holding bonds at a time when losses keep mounting and cash yields are no longer stuck at zero.

No question, replacing bonds with cash would have been a smart move to make nine months ago. But at the beginning of 2022 there was no threat to European energy supplies and inflation didn’t seem out-of-control -- even to the Fed. Now we have a situation where factory capacity in Europe is being permanently reduced for fertilizer, plastic, aluminum, glass, cement, and other basic commodities with high energy-intensity. The world’s central bankers appear to be working together to shrink global demand in hopes of avoiding a second round of inflation pressures driven by rising food, energy and basic commodity prices.

This is not so much a delayed response to pandemic-related supply-chain and labor-market disruptions. Rather, the latest round of tightening moves are more a pre-emptive strike against rising basic materials prices. Industrial capacity cuts in Europe are just getting started and could lead to a second wave of inflation in 2023. Quite clearly, the world’s central banks are determined to avoid that scenario.

The good news? Aggressive tightening moves are likely to do the trick. We probably won’t be surprised as much by upward interest-rate projections in future Fed meetings. The bond market has now factored in a Fed Funds rate that will likely peak at 4.6% in early 2023. That means bonds are less likely to see additional losses going forward. The bond market could bottom out soon if it hasn’t already.

The global oil market may be the best indicator of where bond prices go from here. With oil prices pulling back, most countries will see substantial inflation relief (more than any other single factor). During past inflationary periods, the Fed has sometimes ended its tightening cycle early after oil prices began a precipitous plunge. The dollar’s strength is also a good sign because it makes imported goods less expensive, which for the U.S. is probably the second most important factor putting downward pressure on domestic inflation.

Some of Fidelity’s bond funds have outperformed cash (money market funds) over the last five years. Given the magnitude of this year’s selloff, there is a greater chance that most will do the same over the next three years. Investment Grade Bond, for example, has a 30-day yield of 4.31% as of 9/30/22 -- almost two percentage points higher than Government Cash Reserves’ 7-day yield of 2.51%. Given Investment Grade’s duration of 6.4 years, interest rates would likely need to climb by almost a full percentage point over the next three years for the fund to end up with a lower total return than Gov’t Cash Reserves.

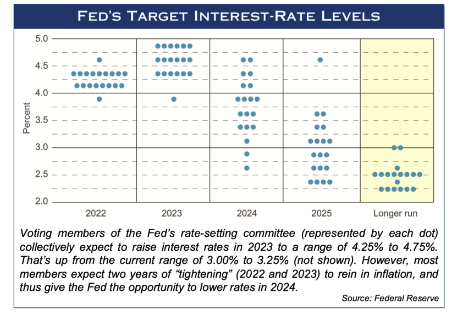

That seems unlikely to happen. The Fed’s own projections show the Fed Funds rate peaking in 2023 then declining in 2024 and 2025. Most likely, bond yields will be lower than they currently are three years from now.

As for the best bond strategy over the next three years, a middle-of-the-road focus on U.S. intermediate maturity investment-grade bond issues should offer the best recovery potential with the least risk.

In contrast, foreign developed-market bonds have lower yields, and emerging-market debt may see continuing pressure due to the dollar’s strength. U.S. high-yield bonds face added default risk as recession effects take hold, meaning their higher yields may not be worth the added risk.

Third Quarter Review

Central banks around the world stepped up their inflation fight in the third quarter. A more aggressive approach was adopted by the Fed to counter robust domestic hiring and surprisingly strong consumer spending, while European central banks shifted to a hawkish approach because of the stark implications of the energy crisis and unexpectedly weak currencies. In both cases, central bankers acknowledged that recessions may be necessary to bring inflation under control, with some expecting a relatively severe slowdown in Europe (the Fed, in contrast, is still projecting positive GDP numbers for the U.S. economy).

With the exception of July, which saw a strong rebound as investors falsely anticipated an early end to the Fed’s string of tightening moves, the stock and bond markets responded negatively. Bonds, which usually benefit from an economic slowdown, declined as much as stocks during the quarter. The entire yield curve was pulled up substantially, in part because the long-end of the curve is set by global factors, and with many foreign central banks now moving as aggressively as the Fed, longterm rates have taken a big jump. For the third quarter, the S&P 500 declined 4.9%, for a year-to-date loss of 23.9%. The Barclay’s U.S. Aggregate bond index declined 4.8%, finishing with a year-to-date loss of 14.6%.

Our portfolios generally performed on par with their stock and bond benchmarks for the quarter, delivering predictable but disappointing performance -- especially in our less-risky portfolios where conservative positioning did little to blunt the decline. There was one bright-spot on the stock side; our sector model benefited from gains in the health care and consumer discretionary groups, which cut losses in accounts with sector exposure.

Outlook

There are several signs that a bottom may be close at hand. In recent weeks, large-cap stocks have seen large declines much like mid-caps and small-caps, which may indicate that stocks are entering the final phase of the selloff. Investor pessimism is high, as are mutual fund cash levels, which suggests upside opportunity may now be greater than downside risk. And once again selling activity appears to have hit an major exhaustion point (for the second time this year), suggesting that most who are inclined to sell have probably done so at this point. Assuming that corporate stock repurchase activity continues to provide a steady and robust stream of cash flowing into equities, the stock market may finally have a chance to mount a sustained rebound once it is no longer being swamped by panic selling activity.

Recovery on the bond side may likely take longer and occur at a slower pace. Though we expect bonds to outperform cash over the next three years, the bond-market’s recovery will likely be driven more by reinvested income than by interest-rate relief from the Fed, which could make it a slow process.

After a roughly 12-year period of lagging the S&P 500, the P/E ratio premium for the S&P 600 smallcap index is now at a 22-year low. This valuation discount, combined with future earnings growth that is less exposed to weak foreign economies (many of which may see a deeper recession than U.S.) may set the stage for smaller stocks to outperform once again, potentially leading the next recovery cycle. As such, we have already boosted small-cap exposure in some portfolios, and we may take that a step further in the fourth quarter.

Given large losses in our conservative portfolios (which many clients use as an income source for living expenses), we plan to look for tax-loss selling opportunities as we continue to modestly upgrade credit quality on the bond side, and also on the stock side where it has potential to impact conservative portfolios. This isn’t normally something we focus on, as mutual fund portfolios offer only limited opportunities on this front, and tax-loss selling doesn’t normally create any long-term value -- in most cases a dollar of taxes saved in the upcoming tax season just means paying a dollar more in the season that follows. But this time around, most of our bond fund positions have unrealized losses that won’t suddenly disappear, and keeping tax bills down could help conservative investors in limiting living-expense draws (hopefully to 4% of total holdings or less). That, in turn, would potentially reduce the recovery delay that might otherwise occur from liquidating a larger-thannormal share of holdings after a significant selloff.

Sincerely,

Jack Bowers

President & Chief Investment Officer