Oil Price Stability May Put the Business Cycle On A Shorter Leash

Global oil markets appear to be entering a new period of stability, where U.S. shale producers rapidly respond to any looming supply shortages, OPEC members cooperate to address any looming gluts, and short-term imbalances are buffered by a 65-day supply of oil in storage (the Strategic Petroleum Reserve, once the world’s largest emergency supply of oil, is now less than15% of the global oil storage picture). The futures market is also playing a more prominent role – it acts like a giant shock absorber by sending price signals that determine whether oil should be stored, or refined and sent to market.

The outcome of this new dynamic? Most likely a narrower trading range for oil, perhaps centered near the $50 mark. That price point is high enough that the most efficient oil producers can make a profit, but low enough that global market share is likely to continue shifting away from OPEC producers. And because shale production is becoming increasingly prolific, the long-term price of oil is likely to lag inflation. It might even continue to slide.

Economic Implications

Capitalistic economies do a good job of boosting living standards through competition and long-term productivity improvements, but periodic contractions have always been part of the landscape. Improved decision-making by central bankers has made economic depressions a rarity among advanced economies, but recessions are still considered unavoidable, and most investors don’t expect bull markets to last for more than a decade.

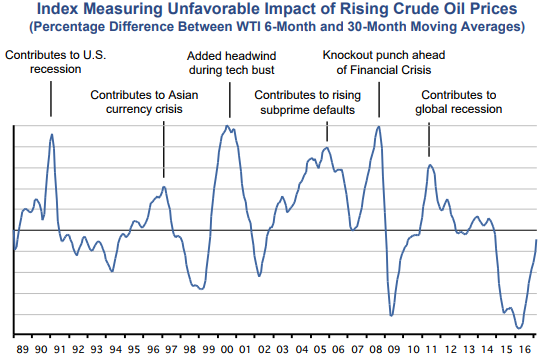

But what if a new era of oil price stability could change all that? Recessions could become relatively rare, and corrections might take the place of many bear markets. The idea is not as outlandish as it might seem. As shown on the chart(next page), almost all recessions have resulted either from rising oil prices, the Fed’s response to higher oil prices, or loans that go bad faster than usual because the price of oil has taken a jump.

Investment Implications

The economic cycle has become a major preoccupation among investment professionals. A lot of effort goes into figuring out what stage of the business cycle each country is in, and which industry groups are likely to outperform or underperform within those stages. But in a world where oil prices don’t jump around much, the business cycle becomes hard to define, setting the stage for the entire school of thought to go the way of the January Effect (which has been dead for more than a decade).

In that scenario, Individual investors might have to alter their perceptions to avoid ill-fated market timing moves. Absent major business cycle fluctuations, charts of earnings and stock prices might look more like a straight line, meaning that investors would have to get used to seeing the major stock indexes set records. And to the degree that inflation settles at a lower level, valuation multiples would probably rise once investors become convinced that the situation is permanent.

Future of Energy

How long could this last? It might go until the end of the oil age. Some forecasting models suggest that oil demand could top out as soon as 2018, thanks to fuel-efficiency gains and the disruption of self-driving vehicles, which could force consumers to go electric for the simple reason that the feature is unlikely to be available with gas engines (gasoline vehicles cannot refuel themselves automatically, and they carry the risk of carbon-monoxide poisoning when operating in an enclosed space). Furthermore, performance electrics are already winning customers, forcing traditional automakers to join the party. Tesla, offering only a single sedan, has managed to capture 8% of the U.S. luxury auto market in just three years. As a result, GM has recently introduced a vehicle to compete directly with Tesla’s mid-priced Model 3 next year, and both BMW and VW are beginning to invest in high-power DC charging networks with the idea of bringing a full lineup of electric vehicles to market between now and 2022. Zero-emission mandates remain on the horizon too. China is moving in that direction more aggressively than any other country, creating a risk that recently forced Toyota back to the electric vehicle drawing board, because hybrids alone aren’t likely to make the cut.

While a major transition like this is almost certain to play out at a snail’s pace, there’s little doubt that oil will be displaced by both renewable electricity and low-cost natural gas in the coming decades. Global oil production is likely to be in steady decline for most of the next 50 years, largely eliminating the need for exploration to keep the world fully supplied at or below today’s costs. As crude becomes less economically relevant with each passing year, the impact of its price fluctuations will shrink accordingly.

Portfolio Strategy

We continue to underweight the energy sector in our portfolios. While many domestic shale drillers are returning to growth, the industry as a whole may face years of downsizing and write-offs. As an alternative, we continue to overweight the industrial sector, which stands to benefit from growth in the shale industry, as well as from low-cost natural gas and LNG exports.

First Quarter Review

A strong job market, along with improving home sales, gave stocks a lift in the first quarter. The rally in large-cap growth stocks remained robust even as expectations for corporate tax reform and deregulation were put on ice. Bond yields surged just prior to the Fed’s March rate hike announcement, but investors relaxed a bit after they were reassured that the pace of future rate hikes would remain gradual. The trade deficit widened as some firms boosted their inventories of imported goods to hedge against the possibility of a future border tax, and oil prices fell asit became clear that domestic shale oil producers will have little trouble replacing any production cuts that OPEC imposes. The dollar’s fourth-quarter surge eased as investors concluded that a border tax (or a border tax adjustment) faces slim odds in Congress, and because robust employment figures have yet to prompt the Fed to act more aggressively.

The S&P 500 rose 6.1% in the first quarter. While our stock portfolios were helped by a full weighting in technology, some were held back by a weak showing for smaller stocks (the Russell 2000 gained only 2.5% as enthusiasm for small-caps waned following an overheated fourth quarter). On the bond side, we outperformed the Barclays U.S. Aggregate (which edged up 0.8%), helping both our blended (stock/bond) and income-oriented portfolios.

Outlook

While some investors have been unnerved by political drama playing out in the White House, the stock market has largely ignored it because what really counts (from a corporate earnings standpoint) are the actions of Congress. While the expected timetable for corporate tax reform and financial deregulation has lengthened considerably, the good news is that very little should change on the trade front, because lingering fears of a trade war have more or less been put to rest by Trump’s largely pro-trade cabinet picks.

We’ve become more bullish on foreign stocks in mature markets such as Europe and Japan. The potential for economic improvement in both regions is now on par with that of our domestic economy, and valuations are slightly lower. As such, we’ve established small (~10%) foreign positions in some of our diversified stock portfolios.

Despite their lagging performance in the first quarter, we still like smaller stocks for several reasons: the U.S. economy is seeing solid growth, energy prices and inflation remain well-controlled, and many larger firms are making plans to boost the amount of production that’s done here in the U.S. Sector-wise, we have a large bet on technology and we added to our overweighted industrials position during the first quarter. On the flip side, we continue to underweight energy and health care. Bond-wise, we recently lightened our exposure to the high-yield sector in our income-oriented accounts, and we plan to do the same for our blended portfolios in the coming weeks.

Sincerely,

Jack Bowers

President & Chief Investment Officer